How to Improve Your Credit Score: A 7-Step Guide for 2025

Did you know that a 100-point difference in your credit score could cost you over $40,000 in extra interest on a 30-year mortgage? In the USA, your three-digit credit score is more than just a number—it’s the financial passport that unlocks lower rates, better loan terms, and greater opportunities. Whether you’re dreaming of a new home, a car, or simply financial flexibility, learning how to improve your credit score is the most powerful step you can take. This comprehensive 2025 guide will walk you through seven actionable steps to understand, raise your credit score, and build a solid financial future. Let’s dive in.

Table Of Content

- Why Your Credit Score Matters in the USA

- How Your Credit Score is Calculated: The 5 Key Factors

- 1. Payment History (35%)

- 2. Credit Utilization (30%)

- 3. Length of Credit History (15%)

- 4. Credit Mix (10%)

- 5. New Credit (10%)

- How to Improve Your Credit Score: 7 Effective Steps

- Step 1: Check Your Credit Reports for Errors

- Step 2: Dispute Any Inaccuracies

- Step 3: Lower Your Credit Utilization Ratio

- Step 4: Always Pay Bills on Time

- Step 5: Become an Authorized User

- Step 6: Use a Secured Credit Card

- Step 7: Avoid Unnecessary Hard Inquiries

- How Long Does It Take to Improve a Credit Score?

- Frequently Asked Questions (FAQ)

- What is the fastest way to improve your credit score?

- Can I pay someone to fix my credit?

- Will checking my credit score lower it?

- What is a good credit score?

- Conclusion: Your Path to a Better Score Starts Now

Why Your Credit Score Matters in the USA

Your credit score is a numerical summary of your financial trustworthiness, used by lenders to gauge risk. In the United States, it impacts nearly every aspect of your financial life:

- Loan Approvals & Interest Rates: The difference between a “good” and “poor” score can mean APR differences of 5% or more on loans and credit cards.

- Housing: Landlords often check credit scores during rental applications. Mortgage lenders offer their best rates only to borrowers with top-tier scores.

- Insurance Premiums: In most states, auto and home insurance companies use credit-based insurance scores to set your premiums.

- Employment: Some employers check credit reports (with your permission) for roles involving financial responsibility.

This system is primarily built on the data collected by the three major credit bureaus: Experian, Equifax, and TransUnion. Your FICO Score, the most commonly used model, is derived from this data.

How Your Credit Score is Calculated: The 5 Key Factors

You can’t win the game without knowing the rules. Your FICO Score is calculated using five key factors, each with a different weight:

1. Payment History (35%)

This is the most critical component. It simply asks: “Do you pay your bills on time?” Even one missed payment can significantly hurt your credit score. This includes credit cards, loans, and even medical bills if they go to collections.

2. Credit Utilization (30%)

This measures how much of your available credit you’re using. It’s calculated per card and overall. For example, if you have a total credit limit of $10,000 and you owe $3,000, your utilization is 30%. The golden rule is to keep this ratio below 30%, but the best scores often have utilization in the low single digits.

3. Length of Credit History (15%)

This factor considers the age of your oldest account, the age of your newest account, and the average age of all your accounts. A longer, well-established history benefits your score. This is why it’s often advised not to close your oldest credit card.

4. Credit Mix (10%)

Lenders like to see that you can manage different types of credit responsibly. This can include revolving credit (like credit cards) and installment loans (like a mortgage or auto loan).

5. New Credit (10%)

Every time you apply for new credit, a hard inquiry is recorded on your report. Too many hard inquiries in a short period can lower your score, as it may indicate you are desperate for credit or a higher risk.

How to Improve Your Credit Score: 7 Effective Steps

Now for the actionable part. Here is your step-by-step plan for credit repair and long-term credit building.

Step 1: Check Your Credit Reports for Errors

The first and easiest step is to see what’s holding you back. You are entitled to a free credit report from each of the three major bureaus every week at AnnualCreditReport.com. This is the only officially authorized site. Carefully review each report for inaccuracies, such as:

- Accounts that don’t belong to you.

- Incorrect payment statuses (e.g., showing a payment was late when it wasn’t).

- Outdated negative items (most should fall off after 7 years).

- Incorrect personal information.

Step 2: Dispute Any Inaccuracies

If you find errors, you must dispute them. You can file disputes online directly with each credit bureau:

- Experian Dispute Center

- Equifax Dispute Center

- TransUnion Dispute Center

Submit your dispute with supporting documentation. The bureaus typically have 30 days to investigate and remove the item if it cannot be verified.

Step 3: Lower Your Credit Utilization Ratio

This is one of the fastest ways to boost your credit score. You can lower your utilization by:

- Paying down balances: Focus on paying off debt, not just making minimum payments.

- Asking for a credit limit increase: If you have a good payment history, call your card issuer and request a higher limit. This instantly lowers your utilization without requiring you to pay down debt. (Note: Ensure they can do this with only a “soft inquiry”).

- Making multiple payments per month: Paying part of your balance before the statement closing date ensures a lower balance is reported to the credit bureaus.

Step 4: Always Pay Bills on Time

Since payment history is 35% of your score, consistency is key. If you struggle with due dates:

- Set up autopay: Automate at least the minimum payment for all your accounts.

- Use calendar reminders: Set alerts for a few days before payments are due.

- Contact lenders if you can’t pay: If you’re facing hardship, proactively call your lender. They may offer a hardship plan that won’t be reported as a missed payment.

Step 5: Become an Authorized User

If you have a family member or spouse with a long-standing credit card in good standing, ask if they will add you as an authorized user. Their positive payment history and credit limit can be added to your credit file, giving your score a quick boost. Ensure the card issuer reports authorized user activity to the bureaus.

Step 6: Use a Secured Credit Card

If you have no credit or are rebuilding bad credit, a secured credit card is one of the best tools. You provide a cash deposit as collateral (e.g., $500), which usually becomes your credit limit. Use it for small, recurring purchases (like a Netflix subscription) and pay the balance in full every month. This activity builds positive payment history. After 6-12 months of on-time payments, you may qualify for an unsecured card and get your deposit back.

Step 7: Avoid Unnecessary Hard Inquiries

Be strategic about applying for new credit. Each application triggers a hard inquiry that can ding your score by a few points. When rate shopping for a major loan like a mortgage or auto loan, try to do all your applications within a focused 14-45 day window. FICO scoring models typically count all inquiries within this window for the same type of loan as a single inquiry.

You May Also know: How To Get Best Insurance Policy

How Long Does It Take to Improve a Credit Score?

Patience is crucial. Improving your credit score is a marathon, not a sprint. Here’s a realistic timeline:

- 1-2 Months: Lowering your credit utilization can yield surprisingly fast results, sometimes within a single billing cycle.

- 3-6 Months: Building positive history with a new secured card or consistent on-time payments will start to show significant improvement.

- 7+ Months: Disputing and removing errors, as well as the aging of your accounts, require more time but offer substantial long-term benefits.

Negative items like late payments and collections will have less impact over time and typically fall off your report after seven years.

Frequently Asked Questions (FAQ)

What is the fastest way to improve your credit score?

The quickest fixes are reducing your credit utilization ratio below 30% and disputing inaccurate negative items from your credit report. For immediate, significant errors, some lenders offer “rapid rescoring” for a fee.

Can I pay someone to fix my credit?

Yes, credit repair companies exist, but be cautious. Many promise more than they can deliver. The Federal Trade Commission (FTC) warns that you have the right to dispute errors yourself for free. If you hire a company, understand your rights under the Credit Repair Organizations Act (CROA).

Will checking my credit score lower it?

No. Checking your own score results in a “soft inquiry,” which does not affect your credit at all. Only “hard inquiries” from lenders when you apply for credit can have a minor, temporary negative impact.

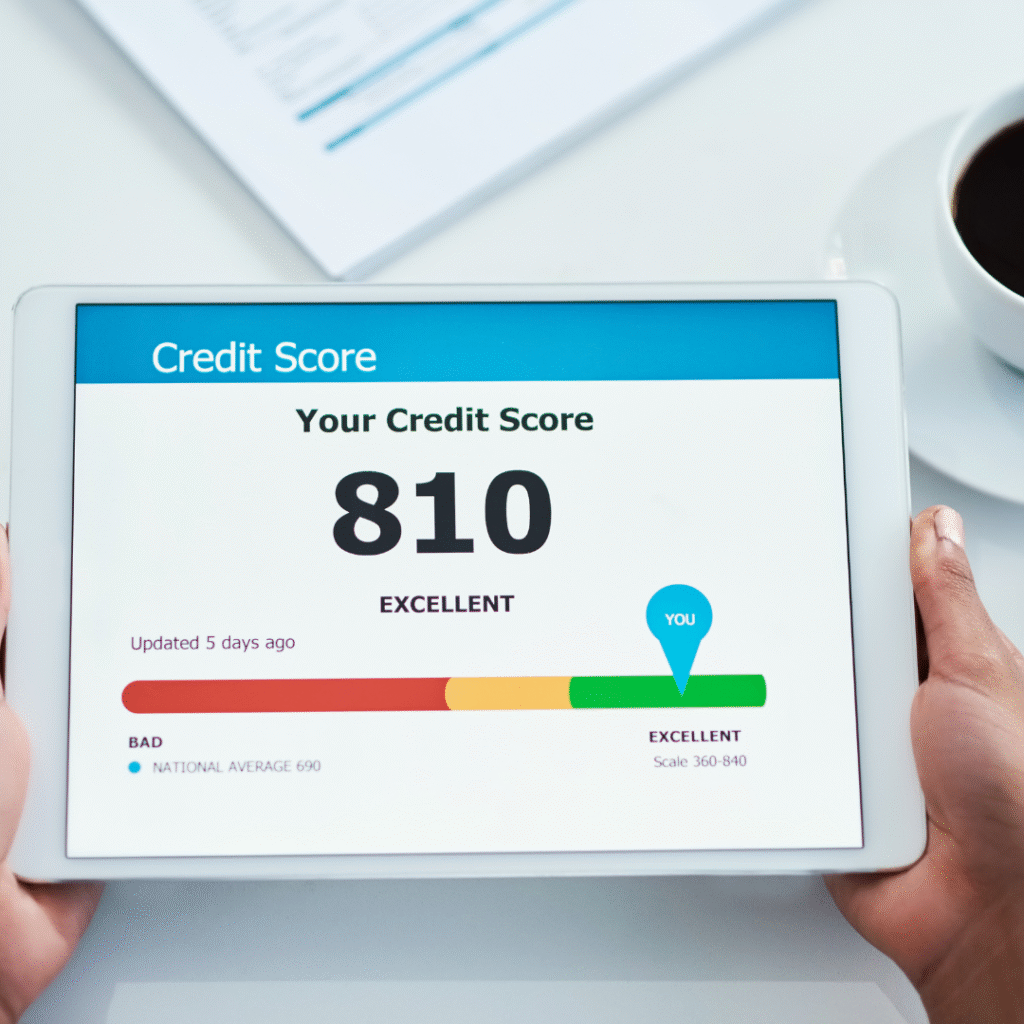

What is a good credit score?

FICO Scores range from 300 to 850. Generally:

- 800-850: Excellent

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

Aim for a score of 670 or higher to qualify for most conventional loans at good rates.

Conclusion: Your Path to a Better Score Starts Now

Learning how to improve your credit score is an investment in your financial freedom. While it requires discipline and patience, the payoff—lower interest rates, less stress, and more opportunities—is immense. Start today by pulling your free credit reports and making a plan. Track your progress with free tools from your bank or credit card issuer. Remember, every on-time payment and every dollar of debt paid down brings you one step closer to a stronger financial future.

Ready to take control? Visit AnnualCreditReport.com now to get your free reports and begin your journey.

Disclaimer: This article is for educational purposes only and does not constitute financial or legal advice. Please consult a qualified financial advisor for personalized guidance.

No Comment! Be the first one.